, Craft Spirits Weekly, News, American Craft Spirits, CBMTRA, Copperworks Distilling Co., Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Crooked Stave, Deerhammer Distillery, Distilled Spirits, FDA Sanitizer Fees, Kōloa Kaua'i Reserve Five-Year Aged Hawaiian Rum, Kōloa Rum, Permanent FET Relief

Craft Beverage Modernization and Tax Reform Act

The Monthly Mash: December 2020

, News, The Monthly Mash, American Craft Spirits, American Shochu Co., Brooklyn Gin, CBMTRA, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Craft Spirits Live, Craft Spirits Magazine, Craft Spirits Packaging Awards, Dietary Guidelines, Distilled Spirits, Esencia Barrel Aged Spiced Rum, FET Relief, Glass Packaging Institute, Judging of Craft Spirits, Lew Bryson, Rockfilter Distillery, Social Hour Cocktails, St. Petersburg Distillery, Standards of Fill, The Craft Spirits Podcast, The Family Jones, Whalen Insurance

The Monthly Mash Volume 5.12 Member-Owned, Industry-Driven ACSA Mission: To elevate and advocate for the community of craft spirits producers. From the Desk of Margie A.S. Lehrman, Chief Executive Officer Dear Friends in the Industry: Entering our home basement storage area to gather the season’s decorations, I was startled...

Craft Beverage Modernization and Tax Reform Act Passes in U.S. House of Representatives, Goes Before Senate, President

December 21, 2020 (Washington, D.C.) – Following approval in the U.S. House of Representatives tonight by a vote of 359/53, the Senate is now expected to vote on and pass the Craft Beverage Modernization and Tax Reform Act (CBMTRA) later tonight or early tomorrow. The President will then sign...

CEOs of Major Beverage Alcohol Associations Send Letter to Congress Urging Immediate Passage of Craft Beverage Modernization and Tax Reform Act

, Advocacy, Congress, News, Press Releases, American Craft Spirits, CBMTRA, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Distilled Spirits

– Struggling Craft Producers Face Significant Tax Hike if Congress Fails to Act by Year-End – WASHINGTON – Chief executive officers from eight major beverage alcohol associations sent a letter to Congressional leaders today urging immediate passage of the bipartisan Craft Beverage Modernization and Tax Reform Act, S. 362/H.R. 1175 (CBMTRA)...

A STATEMENT FROM ACSA CEO MARGIE A.S. LEHRMAN & PRESIDENT BECKY HARRIS ON FEDERAL EXCISE TAX (FET) RELIEF

, Advocacy, Congress, News, Press Releases, ACSA, American Craft Spirits, Catoctin Creek Distilling Co, CBMTRA, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Distilled Spirits

Washington, D.C. (December 1, 2020) — The American Craft Spirits Association (ACSA) applauds Sen. Ron Wyden (D-OR) and Sen. Rob Portman (R-OH), who sent an urgent letter to Senate Majority Leader Mitch McConnell and Minority Leader Charles Schumer today urging the passage of the Craft Beverage Modernization and Tax Reform Act (CBMTRA,...

The Monthly Mash: November 2020

, News, The Monthly Mash, American Craft Spirits, CBMTRA, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Craft Spirits Magazine, Distilled Spirits, Glass Packaging Institute, Last Call Day of Action

The Monthly Mash Volume 5.11 Member-Owned, Industry-Driven ACSA Mission: To elevate and advocate for the community of craft spirits producers. From the Desk of Margie A.S. Lehrman, Chief Executive Officer Dear Friends in Our Craft Spirits Community: With Thanksgiving in our rearview mirrors, I remain focused on gratitude. We...

LAST CALL: December 1 Day of Action

, News, Press Releases, CBMTRA, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Distilled Spirits

November 30, 2020 LAST CALL: December 1 Day of Action Planned to Urge Congressional Passage of Craft Beverage Modernization and Tax Reform Act Before Year-End Deadline WASHINGTON – Leaders in the beverage alcohol sector are urging industry advocates across the nation to participate in a national Day of Action on December 1...

Tax cut extension ‘imperative’ for US craft distillers

, News, Relevant Articles, American Craft Spirits, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Distilled Spirits, FET

The monumental passing of the Craft Beverage Modernization and Tax Reform Act in 2017 marked the first time the US government reduced taxes for spirits producers of all sizes since the Civil War. The act, which was announced as part of president Donald Trump’s US$1.4 trillion tax reform bill,...

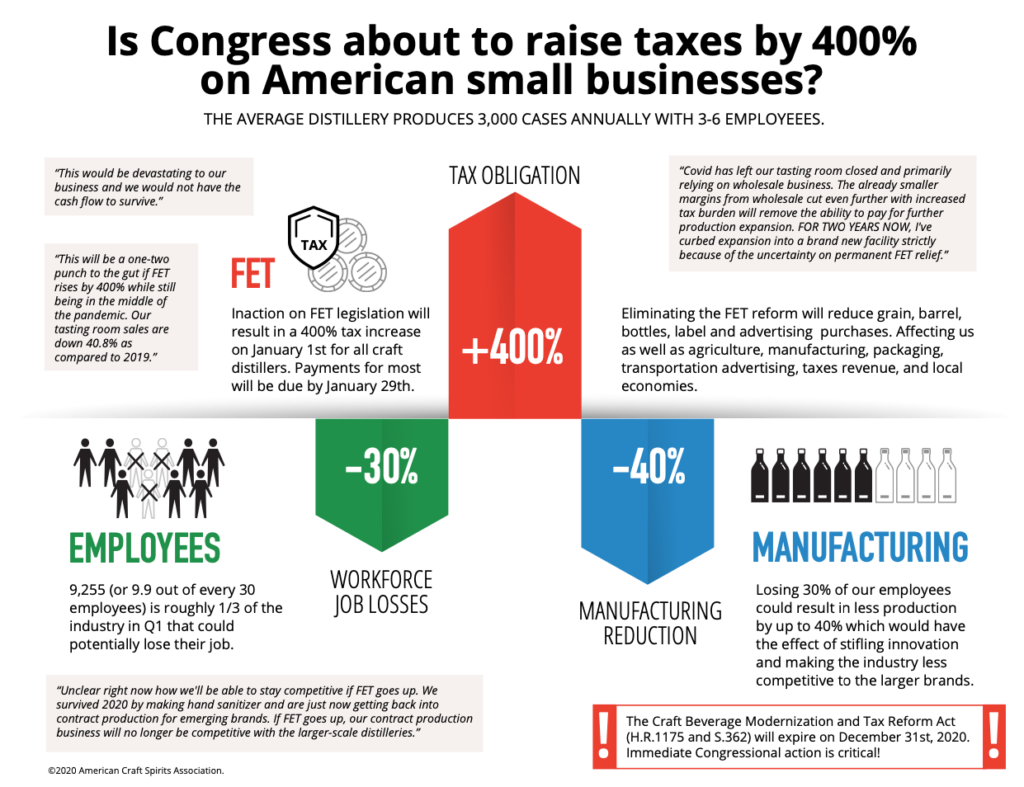

Continued FET Reform Needed to Prevent Massive Job Loss in Craft Distilleries Through the U.S.

, Advocacy, Congress, Federal, American Craft Spirits, American Craft Spirits Association, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Distilled Spirits, FET

ACSA-FET-SheetDownload

The Monthly Mash: October 2020

, News, The Monthly Mash, American Craft Spirits, American Distilled Spirits, Bar Convent Brooklyn, Cart/Horse Distilling, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Craft Spirits Live, Craft Spirits Magazine, Craft Spirits Packaging Awards, Dalkita, Distilled Spirits, Distillers Convention and Vendor Trade Show, Federal Excise Tax, FET, Global Bar Week, Judging of Craft Spirits, The Monthly Mash

The Monthly Mash Volume 5.10 Member-Owned, Industry-Driven ACSA Mission: To elevate and advocate for the community of craft spirits producers. From the Desk of Margie A.S. Lehrman, Chief Executive Officer Dear Friends in Our Craft Spirits Community: Entering my neighborhood recently, I passed a sign I must have seen...

American Craft Spirits Association and Distilled Spirits Council Co-Host Annual Public Policy Conference September 15-16

, News, Press Releases, American Craft Spirits, CBMTRA, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Distilled Spirits, Public Policy Conference

WASHINGTON, D.C. – Distillers from across the country will gather virtually September 15-16 for the distilled spirits industry’s annual Public Policy Conference co-hosted by the American Craft Spirits Association (ACSA) and Distilled Spirits Council of the United States (DISCUS). Click here to register. “As our industry slowly and safely crawls back...

Distillers, Relieved Over Extension Of Federal Tax Reductions, Promise To Fight To Make Them Permanent

, Advocacy, Congress, News, Relevant Articles, Becky Harris, Catoctin Creek, CBMTRA, Craft Beverage Modernization and Tax Reform Act

Congress gave distillers a reprieve Thursday by voting to extend critical tax breaks to the spirits industry for one year. By passing one of two remaining spending packages by a vote of 71-23, senators affirmed a vote their House colleagues took Tuesday to let the Craft Beverage Modernization and...

American Craft Spirits Association Toasts to Federal Excise Tax Reform Extension

, Advocacy, Congress, News, Press Releases, CBMTRA, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Distilled Spirits, Federal Excise Tax, FET

For Media Inquiries: Alexandra S. Clough GATHER PR Alexandra@gatherpr.com 516.428.7210 American Craft Spirits Association Toasts to Federal Excise Tax Reform Extension Craft Distillers Earn Tax Parity for One More Year December 20, 2019 (Washington) – Following approvals in the U.S. House and Senate, today the President passed the Craft...

U.S. SENATE PASSES FET EXTENSION FOR ONE YEAR TERM LEGISLATION SET TO CROSS PRESIDENT’S DESK BEFORE FRIDAY

, Advocacy, Congress, Press Releases, CBMTRA, Craft Beverage Modernization and Tax Reform Act, Craft Spirits, Distilled Spirits, Federal Excise Tax, FET, Margie A.S. Lehrman

For Media Inquiries: Alexandra S. Clough GATHER PR Alexandra@gatherpr.com 516.428.7210 U.S. SENATE PASSES FET EXTENSION FOR ONE YEAR TERM LEGISLATION SET TO CROSS PRESIDENT’S DESK BEFORE FRIDAY December 19, 2019 (Washington) – The U.S. Senate has passed a one-year extension of the Craft Modernization and Tax Reform Act (CMBTRA)...

Sponsor Spotlight

Recent Publications

- ACSA Joins Industry Leaders Urging U.S.-EU Agreement to Protect Spirits Trade and Hospitality Jobs

- ACSA Spring 2025 Advocacy Report

- ACSA Strengthens Membership and Editorial Teams with Key Staff Changes

- ACSA Comments Regarding Reducing Anti-Competitive Regulatory Barriers

- Congress Members Introduce Bipartisan USPS Shipping Equity Act