Congress of the United States Washington, DC 20515 Support America’s Brewers, Vintners, Distillers and Cider Makers Cosponsor H.R. 1175 Supported by: American Craft Spirits Association, American Farm Bureau Federation, Beer Brewers Association, Can Manufacturers Institute, Distilled Spirits Council, Glass Packaging Institute, Hop Growers of America, National Barley Growers Association,...

Advocacy

ACSA Provides Comments to TTB’s Proposed Rulemaking to Modernize Labels

June 26, 2019 Ms. Amy Greenberg Director, Regulations and Rulings Division Alcohol and Tobacco Tax and Trade Bureau 1310 G Street NW Box 12 Washington, DC 20005 BY ELECTRONIC SUBMISSION American Craft Spirits Association Comments on TTB Proposed Rulemaking 27 CFR Parts 4,5,7,14 and 19 Modernization of the...

Craft Beverage Extenders Letter to Ways and Means Committee

June 19, 2019 The Honorable Richard Neal Chair The Honorable Kevin Brady Ranking Member Committee on Ways & Means U.S. House of Representatives Washington, DC 20515 Dear Chairman Neal and Ranking Member Brady: We are grateful that the Craft Beverage Modernization and Tax Reform Act is among the 2019...

Bipartisan Majority of Representatives and Senators Back Craft Beverage Modernization and Tax Reform Act

FOR IMMEDIATE RELEASE: June 6, 2019 Bipartisan Majority of Representatives and Senators Back Craft Beverage Modernization and Tax Reform Act Broad alcohol trade group coalition presses to make federal excise tax reform permanent WASHINGTON, DC – Support for the Craft Beverage Modernization and Tax Reform Act (H.R. 1175/ S.362)...

Request for TTB Appropriations

March 19, 2019 United States House of Representatives Committee on Appropriations Room H-305, The Capitol Washington, DC 20510 United States Senate Committee on Appropriations Room S-128, The Capitol Washington, DC 20510 Dear Chairwoman Lowey, Chairman Shelby, Ranking Member Granger and Vice Chairman Leahy: We are writing to urge Congress...

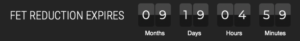

9 Months 19 Days 4 Hours: Do You Know What This Is?

From the Desk of Mark Shilling, former ACSA President and Legislative Affairs Chair March 11, 2019 As the new Congress settles in and gets down to legislative business, I want you to be aware of the extensive behind the scenes work that ACSA and its legislative affairs committee are...

REGISTER HERE: 2019 Public Policy Conference

July 22-24, 2019 Phoenix Park Hotel, Washington, D.C. The American Craft Spirits Association and the Distilled Spirits Council invite you to attend our Public Policy Conference July 22-24, 2019, in Washington, D.C, where members of the distilled spirits sector will meet with lawmakers and advocate in support of critically...

GRASSROOTS FET REDUCTION

What is at Stake The reduced Federal Excise Tax (FET) will expire on December 31, 2019. The rate will increase from $2.70 to $13.50 pg. Background In 2017, Congress enacted, for the first time, parity for craft spirits and provided a reduced FET for distillers. Before the passage of...

Former ACSA President, Paul Hletko, Responds to Questions on Tariffs and Impact on Trade

Watch the clip here.

Co-Sponsor CBMTRA 116th Congress-Senate

Dear Senator, On behalf of the beverage alcohol community, we urge you to co-sponsor the Craft Beverage Modernization and Tax Reform Act (S. 362), legislation introduced by Senators Ron Wyden (D-OR) and Roy Blunt (R-MO) to permanently establish reduced federal excise taxes and modernized regulations for brewers, cider makers,...

CRAFT BEVERAGE MODERNIZATION & TAX REFORM ACT REINTRODUCED TO HOUSE BY CONGRESSMEN KIND & KELLY

Permanent Excise Tax Remains ACSA’s Main Focus in 2019 Washington, DC (February 13, 2019) – The Craft Beverage Modernization and Tax Reform Act (CBMTRA), which would offer the craft distilling community permanent Federal Excise Tax (FET) relief, a benefit that the beer and wine industries have enjoyed for some time,...

ACSA Comment on Drawback

September 17, 2018 Trade and Commercial Regulations Branch Regulations and Rulings Office of Trade U.S. Customs and Border Protection, 90 K Street NE, 10th Floor, Washington, DC 20229-1177 Re: USCBP-2018-0029 Dear Sir/Madam: I am writing on behalf of the American Craft Spirits Association, the only national trade group representing...

Impassioned Craft Spirits Producers Make Case for Permanency of Reduction of FET

ACSA asked many members to share how they are reinvesting savings from their reduced Federal Excise Tax. Here is a video clip which demonstrates our craft spirits community is hiring more employees, buying more equipment, providing enhanced benefits, buying more grain, and promoting tourism. In short, the reinvestment throughout...

U.S. Distilled Spirits and Retaliation: Impact on Texas

U.S. Distilled Spirits and Retaliation: Impact on Texas The distilled spirits sector has a significant economic impact in the state of Texas, representing approximately 83,000 in-state jobs, $7.5 billion in economic activity; and $863 million in state and local taxes. According to the U.S. Census, in 2017 Texas exported...

Recent Publications

- ACSA Joins Industry Leaders Urging U.S.-EU Agreement to Protect Spirits Trade and Hospitality Jobs

- ACSA Spring 2025 Advocacy Report

- ACSA Strengthens Membership and Editorial Teams with Key Staff Changes

- ACSA Comments Regarding Reducing Anti-Competitive Regulatory Barriers

- Congress Members Introduce Bipartisan USPS Shipping Equity Act