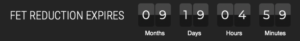

NEWS RELEASE For Immediate Release: December 17, 2019 Contact: Lisa Hawkins 202-256-1330 Leaders from the Distilled Spirits Industry Applaud Senate Leader McConnell for Support of Craft Beverage Modernization and Tax Reform Act WASHINGTON – Following the introduction of legislation that contains a one-year extension of the Craft Beverage Modernization and Tax Reform Act (S.362/H.R. 1175), the...

Leaders from the Distilled Spirits Industry Applaud Senate Leader McConnell on Support and Passage of Craft Beverage Modernization and Tax Reform Act